January 2019 - How the new IIT calculation method will impact your net salary during the year?

Mazars Newsletter - January 2019

The new Individual Income Tax Implementation Rules have finally been implemented and taken effect from January 1st, 2019 onward. Among those changes mentioned in the SAT Public Notice (2018) No 61, the changes in the calculation method for monthly IIT on salaries and wages for resident taxpayers should be singled out for consideration.

The new Individual Income Tax Implementation Rules have finally been implemented and taken effect from January 1st, 2019 onward. Among those changes mentioned in the SAT Public Notice (2018) No 61, the changes in the calculation method for monthly IIT on salaries and wages for resident taxpayers should be singled out for consideration.

In our latest newsletter, Mazars provides you with:

The formula to calculate the IIT

Prepaid withholding tax payable in the current period=(Accumulative Withholding Taxable income*Prededuction rate-quick calculation deduction)-accumulated tax deduction- accumulated tax withheld and paid in advance.

To explain the calculation , we provide an example as below:

Staff A’s monthly salary is RMB 30,000, and he enjoys the following deductions:

- Three types of social insurance (endowment insurance, medical insurance, unemployment insurance) and one fund (housing provident fund) eqaul RMB 4,500,

- Additional itemized deductions including child education and elderly support equal RMB 2,000

- Monthly deduction equals RMB 5,000

The IIT he should pay in the first three months:

- January: (30000-5000-4500-2000)×3%=555

- February: (30000×2-5000×2-4500×2-2000×2)×10%-2520-555=625

- March: (30000×3-5000×3-4500×3-2000×3)×10%-2520-555-625=1850

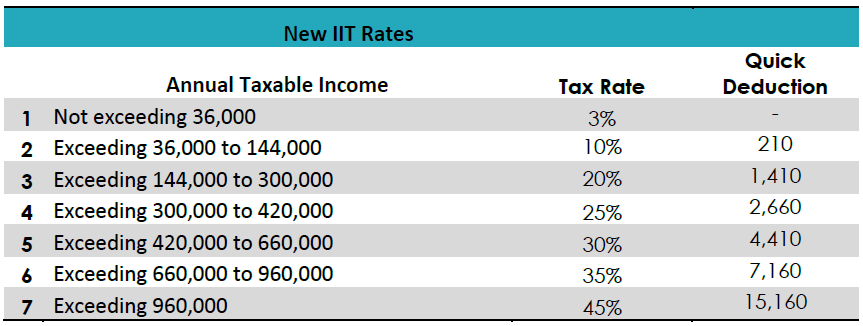

Individual income tax rates

Please download the newsletter to find more information about the new IIT calculation.