Mar 2022 - The extension of existing policies aimed at postponing the collection of certain taxes for manufacturing SMEs

To promote steady growth and support small and medium-sized enterprises in the industrial sector, the State Taxation Administration announced the extension of existing policies aimed at postponing the collection of certain taxes for manufacturing SMEs. We summarize down below key takeaways of this announcement.

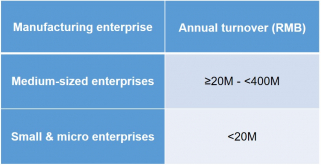

Who is concerned?

Tax Period

From October 2021 to June 2022.

Taxes Concerned

- Enterprise Income Tax (EIT)

- Value-Added Tax (VAT)

- Consumption tax

- Local surcharges (Urban Maintenance and Construction Tax, Educational Surcharge, Local Educational Surcharge)

Deferred Tax Payment

- Medium-sized enterprises: 50% of tax due

- Small and micro enterprises: 100% of tax due

Deferred Time

6 months after tax returns are filed.

This policy is implemented from 28 February 2022.

If you have any question or need any assistance, please do not hesitate to reach out to your Mazars point of contact.